Sometimes You Have to Share

Sharing equity interest with co-founders, employees, and investors is often essential, but giving up ownership interest does not necessarily mean giving up control.

Just because someone gives you their time or money, does not mean they should have a say on how you run your company. So what if that partner brings the “business expertise” or that “tech expertise?” Have an experienced venture capitalist? Big deal. Someone quit their job to be employed at your startup? So did you. These people deserve to be rewarded and will be rewarded, but you need to set terms that ensure the success of the business.

The traditional thought is that the more you own, the more you control. This does not have to be the case. There are plenty of reasons why the actual decision maker(s) may not be a majority owner, but be the individual(s) in the best position to run the company. Frankly, some entrepreneurs just need the control to be successful.

Passion, Expertise and Ethics

- Maintaining control of your business requires you to first ask yourself if you truly deserve the control and if you are the best person to do it. It requires passion, expertise, and ethics.

Some may disagree whether ethics is required, but control is power. It is dangerous. There are surefire ways to ensure legal control and freedom of your company, but that does not mean someone will not try to fight for it. They no doubt will, if your power is abused.

Accordingly, please use these tips wisely!

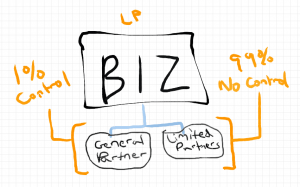

Your New Favorite Tool: Limited Partnerships (LPs)

Most of this guide focuses on limited partnerships. Limited partnerships are the only entity in which it is possible by default for a partner to own 99% of the company, yet have little to no control of the company. For those control seeking founders, limited partnerships are by far the premier entity tool for a business. All it takes is being a part of one LP and you are addicted.

Some information online will tell you that LPs are vehicles for private equity firms or real estate projects. Though they may be used in that fashion, LPs are actually quite flexible. In fact, this is the number one problem with working with LPs, i.e. many are not familiar with it and therefore shy away.

The Basics Structure of an LP

Limited partnerships require at least one general partner and one limited partner. A limited partner in line with its name, is granted limited liability in the same way that a shareholder of a corporation or member of an LLC is granted. A general partner, however, is exposed to unlimited liability, such as the liability of a sole proprietor.

In exchange for the exposure of liability, general partners (usually there is only one) are given virtually full, exclusive management and control of the business. This is regardless as to how much ownership interest they may own. In fact, it is common for a general partner to own only 1% of a limited partnership. A limited partner on the other hand is not allowed to exert too much control over the partnership or they would be exposing themselves to liability.

Unlimited liability of a multi-million dollar business does not really seem like an attractive position. This is why the general partnership interest is always held by a separate entity like a corporation or an LLC.

This practice of entity-owned general partners became so common that some states adopted a varied LP. A relatively newer type of entity that removes the general partner liability under an even lesser known entity called a limited liability limited partnership (LLLP). Note that even where a state may not have an LLLP entity available, they will often permit an LLLP registered in a foreign state to be permitted to do business in that state as an LLLP.

General Partner

If you want to maintain control of the limited partnership, you must be (1) the only general partner, and (2) be the sole owner of the entity that is named the general partner. This does not mean you are prohibited from owning the limited partnership as a limited partner in addition to being a general partner. In fact, it is typical for a controlling person to directly or indirectly own both a general partner and limited partner ownership interest in the LP.

Alternatively, it may be that you wish to only share control among a select few founders while still taking on a larger number of investors and equity holders. This is easily accomplished by making the entity that is designated as the general partner to have a split equity interest. You can then alter the control dynamics within that entity’s controlling documents.

According to the uniform limited partnership act, that most states follow, a general partner can only be removed with the unanimous consent of the limited partners unless the partnership agreement says otherwise. Even if you do control your company, you will still want a minimally significant limited partnership interest in order to benefit from the business’ gains.

Also keep in mind that if all the limited partners besides you want to remove a general partner and you have a smaller stake, there will be issues even if the other limited partners do not have enough votes despite what your limited partnership agreement states.

A typical limited partnership structure may look something like this:

General Partner

1% – Your Limited Liability Company, LLC

Limited Partners

24% – You

15% – Co-Founder

50% – Investor

10% – Employee

Here, you collectively own 25% of the limited partnership and yet have operational control of 100% of the limited partnership.

Since most partnership agreements have some kind of fail-safe to allow the limited partners to kick out the general partner in some vote, it is best practice to make the ownership interest a super majority that can range from 60 to even 80 percent.

Non-Dilutable Limited Partners

The limited partnership is very flexible. You can even create a non-dilutable class of limited partnership interest. This is not only a great way to maintain your right to a lion’s share of the distribution, but also your control as general partner.

In this structure, you could have investors buy into a dilutable class of ownership interest and maintain the founding members’ ownership interest through a separate class.

It could look something like this:

General Partner

1% – Your Limited Liability Company, LLC

Non-Dilutable Limited Partners

14% – You

10% – Co-Founder

Dilutable Limited Partners

50% – Investor A

10% – Investor B

5% – Employee A

5% – Employee B

5% – Employee C

In the scenario above, you and your co-founder have a non-dilutable interest of 24% (and the general partner 1%). If another investor comes along, it is the 75% of the dilutable limited partners that will be diluted unless they purchase founding limited partnership interest.

Other Entities

In discussing which entity to form, the common analysis is LLC v. corporation v. some other entity no one actually considers. If control is your focus, LLCs and corporations are the other entities.

For the most part, control in an LLC or corporation has little difference and can be approached in a similar fashion.

Corporations

Corporations and LLC’s can be fairly straight forward. Maintain a majority interest in the company and control it. Due to its long history, corporations have many fancy tools to fulfill the tug-of-war between shareholders.

If you are looking for a more nuanced manner of control without the authoritarian cloud that may come with a limited partnership, a corporation is a great alternative.

Minority Rights

Minority shareholders are used to negotiating their minority rights beyond the statutory minimum. Often investors, even if a minority shareholder, may call for control of the board of directors, preemptive rights, or cumulative voting.

Generally though, if you are able to maintain a majority control of stock of your corporation, the minimum statutory minority rights are fairly easy to come by. They include inspection rights, derivative claim rights, and basic protections from oppression. Basically, so long as you are doing what is best for the company and not trying to take any undue advantage over a minority shareholder, you can generally minimize potential liability.

Class of Stock

The classic way, that is still very popular, is to have a class of shares typically named as common stock and preferred stock. Common stock being a voting right with no dividend rights. Preferred stock with no voting right but dividend rights with first rights to money out. There are many subtleties that can come with these classes, including the ability to convert preferred to common or even expanded rights to allow preferred stock voting. In reality, if you want to maintain control, you want plain preferred stock with no bells and whistles.

Keep in mind that s-corporations do not support multiple classes of stock.

Shareholder Agreements

If you want to maintain full control regardless of ownership interest, shareholder agreements are the way to do it. It is the document that can specify voting terms and management for which each shareholder may be bound. Additionally, shareholders that may come to the business later that may be unwilling to sign such shareholder agreements may be subsequently controlled by a voting block formed within the shareholder agreement.

A shareholder agreement can specify that each shareholder agrees to elect specified directors (such as you and your trusted co-founders). Be careful with adding any more additional terms as typically it will include items that may limit control. These include preemptive rights, restrictions on transfer of shares, or limits on corporate expenditures.

Limited Liability Companies (LLC)

Limited liability companies come in two types: (1) member managed and (2) manager managed. A member is an owner of the company and a manager is the operator or similar to a director of a corporation.

If you want to maintain control of your LLC and still give up ownership interest, you need to have a manager managed LLC. This is done at the registration of the LLC itself with your respective Secretary of State.

The legal question now becomes, how do you maintain yourself in being the sole manager or, better put, the controlling manager of the LLC.

Operating and Members Agreements

There are default rules on how limited liability companies are governed absent an operating agreement or other member’s agreement. If you want control, you definitely do not want to depend upon the default rules. On the other hand, you should not just put whatever you want in the operating agreement because there are certain items for which you are unable to contract against.

Like corporations and limited partnerships, LLCs can also have different classes of ownership interest and structure it as a non-voting and voting class of shares. Similarly, if your LLC is an S-corporation for purposes of taxation, then different classes of membership interest will not be an option.

A great alternative that is used often is a members agreement that specifies how members will vote for managers.

Be Careful What You Read

Do a couple searches on Reddit or Quora and you will find a wealth of opinions on how to approach ownership and control of your business in the startup world. You will find that corporations are a part of the startup and VC culture, but sometimes this information can be misleading.

You can safely ignore many of these strategies if control is an important goal. There is a legitimate thought that you should never give up control of your business. It is your business and no amount of money or expertise deserves it to be taken away from you.

![Share Ownership Equity Interest Without Giving Up Control [How To] Share Ownership Equity Interest Without Giving Up Control [How To]](https://www.pashalaw.com/wp-content/uploads/2015/01/Share-Ownership-Equity-Interest-Without-Giving-Up-Control-How-To-1024x543.jpg)

![California v. Texas: Which is Better for Business? [313]](https://www.pashalaw.com/wp-content/uploads/2021/07/Pasha_LSSB_CaliforniaVSTexas-1024x723.jpg)

![More Than a Mistake: Business Blunders to Avoid [312] Top Five Business Blunders](https://www.pashalaw.com/wp-content/uploads/2021/06/Pasha_LSSB_Blunders_WP-1-1024x723.jpg)

![Law in the Digital Age: Exploring the Legal Intricacies of Artificial Intelligence [e323]](https://www.pashalaw.com/wp-content/uploads/2023/11/WhatsApp-Image-2023-11-21-at-13.24.49_4a326c9e-300x212.jpg)

![Unraveling the Workforce: Navigating the Aftermath of Mass Layoffs [e322]](https://www.pashalaw.com/wp-content/uploads/2023/07/Untitled-design-23-300x212.png)

![Return to the Office vs. Remote: What Can Employers Legally Enforce? [e321]](https://www.pashalaw.com/wp-content/uploads/2023/01/Pasha_LSSB_321_banner-300x212.jpg)

![Explaining the Hans Niemann Chess Lawsuit v. Magnus Carlsen [e320]](https://www.pashalaw.com/wp-content/uploads/2022/10/LAWYER-EXPLAINS-7-300x169.png)

![California v. Texas: Which is Better for Business? [313]](https://www.pashalaw.com/wp-content/uploads/2021/07/Pasha_LSSB_CaliforniaVSTexas-300x212.jpg)

![Buyers vs. Sellers: Negotiating Mergers & Acquisitions [e319]](https://www.pashalaw.com/wp-content/uploads/2022/06/Pasha_LSSB_BuyersVsSellers_banner-300x212.jpg)

![Employers vs. Employees: When Are Employment Restrictions Fair? [e318]](https://www.pashalaw.com/wp-content/uploads/2022/05/Pasha_LSSB_EmployeesVsEmployers_banner-1-300x212.jpg)

![Vaccine Mandates Supreme Court Rulings [E317]](https://www.pashalaw.com/wp-content/uploads/2022/02/WhatsApp-Image-2022-02-11-at-4.10.32-PM-300x212.jpeg)

![Business of Healthcare [e316]](https://www.pashalaw.com/wp-content/uploads/2021/11/Pasha_LSSB_BusinessofHealthcare_banner-300x212.jpg)

![Social Media and the Law [e315]](https://www.pashalaw.com/wp-content/uploads/2021/10/WhatsApp-Image-2021-10-06-at-1.43.08-PM-300x212.jpeg)

![Defining NDA Boundaries: When does it go too far? [e314]](https://www.pashalaw.com/wp-content/uploads/2021/09/Pasha_LSSB_NDA_WordPress-2-300x212.jpg)

![More Than a Mistake: Business Blunders to Avoid [312] Top Five Business Blunders](https://www.pashalaw.com/wp-content/uploads/2021/06/Pasha_LSSB_Blunders_WP-1-300x212.jpg)

![Is There a Right Way to Fire an Employee? We Ask the Experts [311]](https://www.pashalaw.com/wp-content/uploads/2021/02/Pasha_LSSB_FireAnEmployee_Website-300x200.jpg)

![The New Frontier: Navigating Business Law During a Pandemic [310]](https://www.pashalaw.com/wp-content/uploads/2020/12/Pasha_LSSB_Epidsode308_Covid_Web-1-300x200.jpg)

![Wrap Up | Behind the Buy [8/8] [309]](https://www.pashalaw.com/wp-content/uploads/2020/11/Pasha_BehindTheBuy_Episode8-300x200.jpg)

![Is it all over? | Behind the Buy [7/8] [308]](https://www.pashalaw.com/wp-content/uploads/2020/09/iStock-1153248856-overlay-scaled-300x200.jpg)

![Fight for Your [Trademark] Rights | Behind the Buy [6/8] [307]](https://www.pashalaw.com/wp-content/uploads/2020/07/Fight-for-your-trademark-right-300x200.jpg)

![They Let It Slip | Behind the Buy [5/8] [306]](https://www.pashalaw.com/wp-content/uploads/2020/06/Behind-the-buy-they-let-it-slip-300x200.jpg)

![Mo’ Investigation Mo’ Problems | Behind the Buy [4/8] [305]](https://www.pashalaw.com/wp-content/uploads/2020/05/interrobang-1-scaled-300x200.jpg)

![Broker or Joker | Behind the Buy [3/8] [304] Behind the buy - Broker or Joker](https://www.pashalaw.com/wp-content/uploads/2020/04/Joker-or-Broker-1-300x185.jpg)

![Intentions Are Nothing Without a Signature | Behind the Buy [2/8] [303]](https://www.pashalaw.com/wp-content/uploads/2020/04/intentions-are-nothing-without-a-signature-300x185.jpg)

![From First Steps to Final Signatures | Behind the Buy [1/8] [302]](https://www.pashalaw.com/wp-content/uploads/2020/04/first-steps-to-final-signatures-300x185.jpg)

![The Dark-side of GrubHub’s (and others’) Relationship with Restaurants [e301]](https://www.pashalaw.com/wp-content/uploads/2015/04/When-Competition-Goes-Too-Far-Ice-Cream-Truck-Edition-300x201.jpg)

![Ultimate Legal Breakdown of Internet Law & the Subscription Business Model [e300]](https://www.pashalaw.com/wp-content/uploads/2019/05/Ultimate-Legal-Breakdown-of-Internet-Law-the-Subscription-Business-Model-300x196.jpg)

![Why the Business Buying Process is Like a Wedding?: A Legal Guide [e299]](https://www.pashalaw.com/wp-content/uploads/2019/03/futura-300x169.jpg)

![Will Crowdfunding and General Solicitation Change How Companies Raise Capital? [e298]](https://www.pashalaw.com/wp-content/uploads/2018/11/Will-Crowdfunding-and-General-Solicitation-Change-How-Companies-Raise-Capital-300x159.jpg)

![Pirates, Pilots, and Passwords: Flight Sim Labs Navigates Legal Issues (w/ Marc Hoag as Guest) [e297]](https://www.pashalaw.com/wp-content/uploads/2018/07/flight-sim-labs-300x159.jpg)

![Facebook, Zuckerberg, and the Data Privacy Dilemma [e296] User data, data breach photo by Pete Souza)](https://www.pashalaw.com/wp-content/uploads/2018/04/data-300x159.jpg)

![What To Do When Your Business Is Raided By ICE [e295] I.C.E Raids business](https://www.pashalaw.com/wp-content/uploads/2018/02/ice-cover-300x159.jpg)

![General Contractors & Subcontractors in California – What you need to know [e294]](https://www.pashalaw.com/wp-content/uploads/2018/01/iStock-666960952-300x200.jpg)

![Mattress Giants v. Sleepoplis: The War On Getting You To Bed [e293]](https://www.pashalaw.com/wp-content/uploads/2017/12/sleepopolis-300x159.jpg)

![The Harassment Watershed [e292]](https://www.pashalaw.com/wp-content/uploads/2017/12/me-2-300x219.jpg)

![Investing and Immigrating to the United States: The EB-5 Green Card [e291]](https://www.pashalaw.com/wp-content/uploads/2012/12/eb-5-investment-visa-program-300x159.jpg)

![Responding to a Government Requests (Inquiries, Warrants, etc.) [e290] How to respond to government requests, inquiries, warrants and investigation](https://www.pashalaw.com/wp-content/uploads/2017/10/iStock_57303576_LARGE-300x200.jpg)

![Ultimate Legal Breakdown: Employee Dress Codes [e289]](https://www.pashalaw.com/wp-content/uploads/2017/08/Ultimate-Legal-Breakdown-Template-1-300x159.jpg)

![Ultimate Legal Breakdown: Negative Online Reviews [e288]](https://www.pashalaw.com/wp-content/uploads/2017/06/Ultimate-Legal-Breakdown-Online-Reviews-1-300x159.jpg)

![Ultimate Legal Breakdown: Social Media Marketing [e287]](https://www.pashalaw.com/wp-content/uploads/2017/06/ultimate-legal-breakdown-social-media-marketing-blur-300x159.jpg)

![Ultimate Legal Breakdown: Subscription Box Businesses [e286]](https://www.pashalaw.com/wp-content/uploads/2017/03/ultimate-legal-breakdown-subscription-box-services-pasha-law-2-300x159.jpg)

![Can Companies Protect Against Foreseeable Misuse of Apps [e285]](https://www.pashalaw.com/wp-content/uploads/2017/01/iStock-505291242-300x176.jpg)

![When Using Celebrity Deaths for Brand Promotion Crosses the Line [e284]](https://www.pashalaw.com/wp-content/uploads/2017/01/celbrity-300x159.png)

![Are Employers Liable When Employees Are Accused of Racism? [e283] Racist Employee](https://www.pashalaw.com/wp-content/uploads/2016/12/Are-employers-liable-when-an-employees-are-accused-of-racism-300x159.jpg)

![How Businesses Should Handle Unpaid Bills from Clients [e282] What to do when a client won't pay.](https://www.pashalaw.com/wp-content/uploads/2016/12/How-Businesses-Should-Handle-Unpaid-Bills-to-Clients-300x159.png)

![Can Employers Implement English Only Policies Without Discriminating? [e281]](https://www.pashalaw.com/wp-content/uploads/2016/11/Can-Employers-Impliment-English-Only-Policies-Without-Discriminating-300x159.jpg)

![Why You May No Longer See Actors’ Ages on Their IMDB Page [e280]](https://www.pashalaw.com/wp-content/uploads/2016/10/IMDB-AGE2-300x159.jpg)

![Airbnb’s Discrimination Problem and How Businesses Can Relate [e279]](https://www.pashalaw.com/wp-content/uploads/2016/09/airbnb-300x159.jpg)

![What To Do When Your Amazon Account Gets Suspended [e278]](https://www.pashalaw.com/wp-content/uploads/2016/09/What-To-Do-When-Your-Amazon-Account-Gets-Suspended-1-300x200.jpg)

![How Independent Artists Reacted to Fashion Mogul Zara’s Alleged Infringement [e277]](https://www.pashalaw.com/wp-content/uploads/2016/08/How-Independent-Artists-Reacted-to-Fashion-Mogul-Zaras-Alleged-Infringement--300x159.jpg)

![Can Brave’s Ad Replacing Software Defeat Newspapers and Copyright Law? [e276]](https://www.pashalaw.com/wp-content/uploads/2016/08/Can-Braves-Ad-Replacing-Software-Defeat-Newspapers-and-Copyright-Law-300x159.jpg)

![Why The Roger Ailes Sexual Harassment Lawsuit Is Far From Normal [e275]](https://www.pashalaw.com/wp-content/uploads/2016/07/WHY-THE-ROGER-AILES-SEXUAL-HARASSMENT-LAWSUIT-IS-FAR-FROM-NORMAL-300x159.jpeg)

![How Starbucks Turned Coveted Employer to Employee Complaints [e274]](https://www.pashalaw.com/wp-content/uploads/2016/07/iStock_54169990_LARGE-300x210.jpg)